Changes

REDW Wealth is committed to providing the best client experience possible, and facilitating change is often a part of that process. Our clients have recently received new and improved quarter-end reports, as an example of our commitment to provide meaningful information about their portfolios. The feedback we have received has been positive, and we are pleased the changes have proven to be helpful.

More changes are on the way, which we hope you will also find useful. Portfolio reports for the Fourth Quarter of 2019, to be distributed in January 2020, will include information about the markets written by our Chief Investment Officer, Daniel Yu. While we know you have access to lots of information about the markets, we hope you will find market information written from our perspective helpful. This information will replace Market View, the newsletter Daniel formerly wrote and distributed during the first month of each quarter.

Daniel will continue to write a newsletter, but it will now be distributed in the second month of each quarter on a topic related in some manner to the financial markets. David Cechanowicz, a Senior Financial Planner with REDW Wealth, will continue to author Planning Matters, which will cover topics related to financial planning and be published the last month of each quarter.

So, what about my newsletter, Capital Conversations, which has been regularly published during the second month of each quarter? This edition will be the last in this form. As we do with any change, based on feedback from you, our clients, we are carefully analyzing what would be most meaningful for you, moving forward. Regardless of the form or title of the publication distributed in the first month of a quarter, know that REDW Wealth is dedicated to providing you with relevant information.

Hard Decisions

Investing is not easy, but nothing important is. Making hard decisions is part of investing wisely. Here are some of the most difficult choices knowledgeable investors must make:

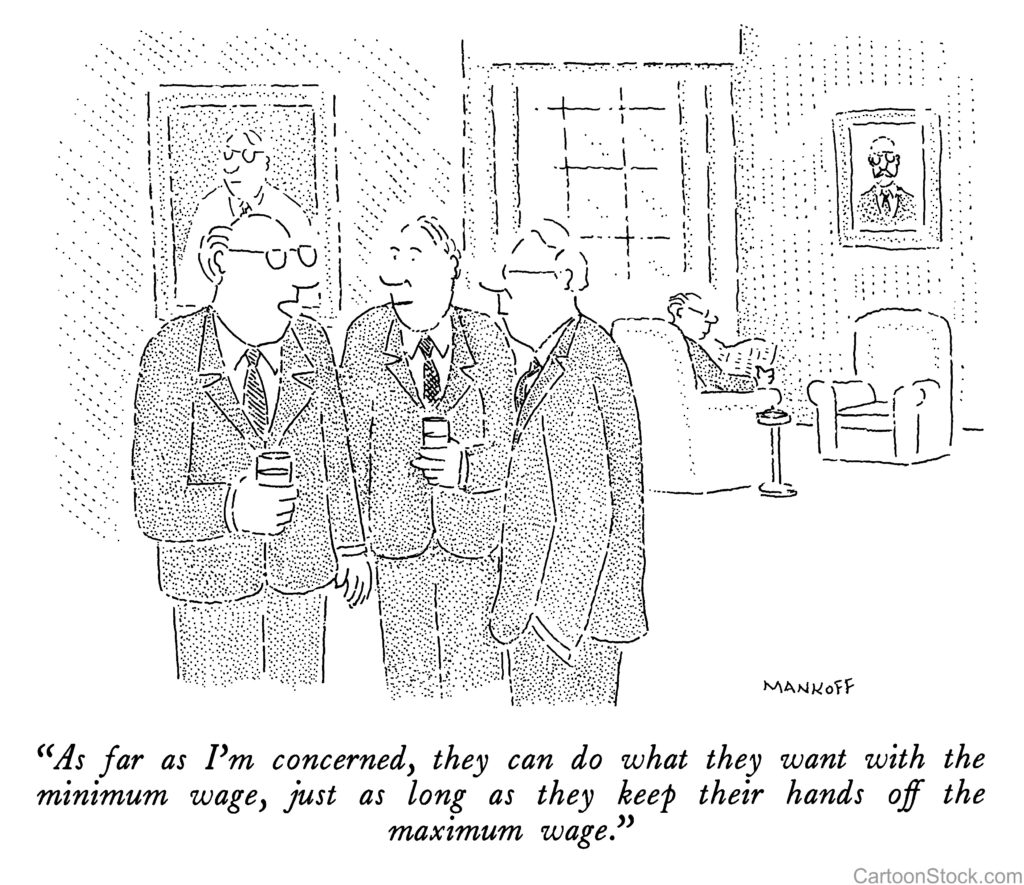

- Work with someone you trust, who is also a fiduciary. Companies and individuals acting as a fiduciary means they have a legal and ethical obligation to put the interests of their clients first. Not all companies and individuals act as a fiduciary to their clients. Why would you work with anyone who may not put your interests before his or her own?

- Beating the market is the wrong goal. Investors tend to take on more risk than is necessary when they try to get a jump on other investors. The better goal is to seek the lowest risk strategy to meet your needs or the highest return you can reasonably expect with your risk tolerance.

- Timing the market is also an inappropriate goal. Many investors think they “know†when to get out of the market, which is an important decision. Equally important is when to get back into the market. Over the years, I have seen investors who “knew†when it was time to get out, but rarely do they have the same conviction about getting back into the market. You need to determine the appropriate asset allocation for you and give up trying to time the market.

- Take only the risk you need to take to meet your goals. Too much risk can decimate a portfolio, and too little risk can result in falling short of your goal.

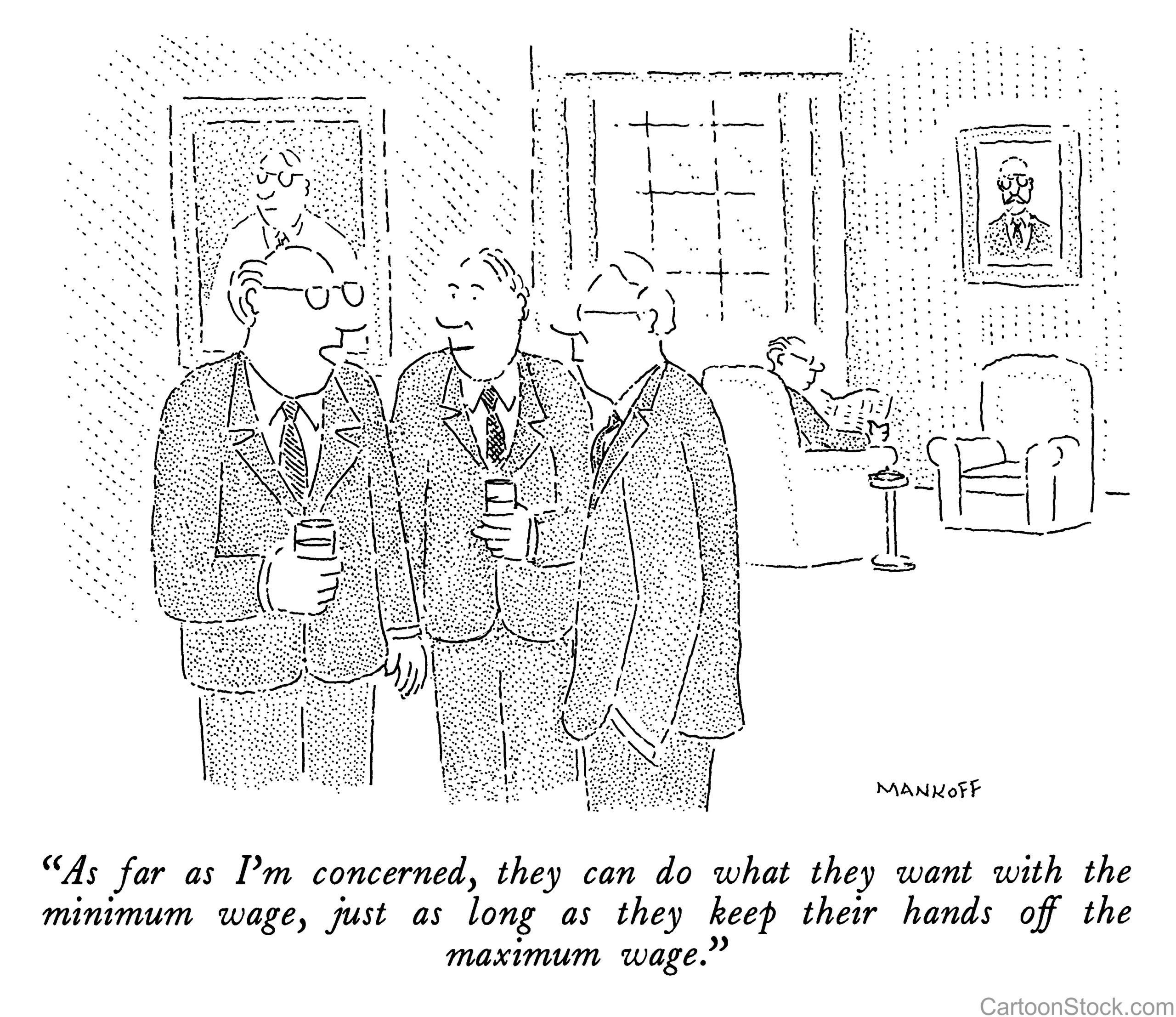

- Supposed “experts†in investing constantly bombard us with news, information and commentary. Because these experts appear connected to what is going on in the financial world, it is difficult to maintain focus on your long-term goals. But do not be fooled by those talking heads: much like the weather, what they talk about is outside your control. And because it is outside your control, how much of your time and effort is worth paying attention? The solution: turn off the TV and spend your time doing what makes you happy.

- Closely related to ignoring the “experts†is, how often should you check your portfolio? If you have realistically assessed your financial needs and your risk tolerance, designed a portfolio that meets those needs and have a plan to meet your goals, checking your portfolio quarterly and making changes when necessary should be adequate. Go and pursue those activities that bring joy into your life.

Things Learned from My Clients

I had the pleasure of working with many clients during my time at REDW Wealth. I sincerely hope they learned something from me, because I certainly learned lots from them! Here is some of what I have taken away from clients:

- Happiness is not directly related to how much money one has. Happiness depends much more on attitudes and behavior than numbers on a piece of paper or in a computer.

- Wealth comes from the choices people make, not necessarily by the chances they take. Rather than from luck, wealth comes from establishing good habits and making deliberate choices. Those choices might be paying yourself first, living below your income and investing the difference, choosing a lifestyle that does not result in large expenses or debts, and making your savings work hard for you.

- Do not wait to start investing. Timing the market is not important, but time in the market is. The earlier you start, the sooner your money begins to work for you.

- Take care of your health. A long life is for those who are still here. To take advantage of living a long life, living a healthy life is paramount. Taking care of the physical and mental aspects of life and following medical professionals’ advice is critical.

- Have a written plan, which contributes to peace of mind and acts as a road map. A written plan can help you see where you are, where you want to go, and what you need to do to get there.

- The quality of the people in your life shapes the quality of your life. It does not matter if those are family or friends, are younger or older, or have more or less money. Enough said.

- Invest like a millionaire. What does that mean? Carefully choose a fiduciary who becomes a trusted advisor, take a long-term view of investing, keep costs as low as possible, and have realistic expectations.

- Active beats lazy every time. Smart people keep themselves active mentally and physically. They are lifelong learners and challenge their brains regardless of what else is going on in their lives. They read, do crossword puzzles, Sudoku or word games, take a class, teach a class or travel. They try new things wherever they are.

- Happy people I know, regardless of whether they are working or not, have no problem making a list of the things they want to do or see if they had the time. Places to go, people to see, books to read, sports to play. These people know there is no guarantee that tomorrow will come and find ways to make their dreams come true.

- As we approach the end of the year, say “Goodbye†with thanks to 2019 and say “Hello†with gratitude and anticipation of what 2020 will bring to you and your family, making sure the professionals of REDW Wealth are part of your life. You are a part of ours.

Did You Know?

The Firm: REDW just celebrated its 10th Annual Tribal Finance & Leadership Conference, Nov. 13-14 at Bally’s Las Vegas, followed by an exclusive Tribal Gaming Leadership Summit on Nov. 15. This year’s event featured more than 20 speakers and drew 110 attendees, representing 52 tribal entities from 14 states, for a unique opportunity to address the top financial, leadership, legal, and human resources issues impacting Native Americans today.

The Economy: The average car loan stretches for roughly 69 months, a record. In the first half of this year, 1.5% of auto loans for new vehicles had terms of 85 months or longer, according to Experian. Five years ago, these eight and nine-year loans were practically nonexistent. Source: Wall Street Journal

Our Clients: As a Registered Investment Advisor (RIA) regulated by the Securities and Exchange Commission (SEC), REDW Wealth operates as a fiduciary. (Not all companies and individuals in our industry act as a fiduciary to their clients.) Being a fiduciary means we have a legal and ethical obligation to put the interests of our clients first, at all times, and regardless of the services we provide. Our clients’ needs are always paramount as we work toward helping them achieve their financial goals.

Copyright 2019 REDW Wealth LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.