One of the most commonly used words in 2020 was “unprecedented.â€

The COVID-19 pandemic created an unprecedented set of circumstances as massive economic shutdowns worldwide led to a global recession. The scale of societal impacts was also unprecedented. Some have said that five to ten years’ worth of changes in the workforce were compacted into a single year. Central banks around the world responded to the crisis with unprecedented speed to shore up confidence in the capital markets. Scientists were able to sequence the genome of the virus with unprecedented speed, as well, and even deployed a new technology for vaccine development. And as we all quickly adapted to our new environment, economic recovery was fairly rapid, too.

As we look ahead to the future, every nation and locality will need to have a wide-ranging discussion on their response to the next pandemic that is sure to emerge, and the total societal costs of that response. While no one can predict the type or timing of the next new disease, it will be important for us to determine ahead of time the approaches and actions we ought to take if and when it arises.

Looking forward, we do expect the continuing development of new technologies to address these emerging issues. New remote work, broadband, online retail, and contactless payment technologies weren’t developed to address the challenges of a global pandemic, but we collectively adopted them to help us cope. While many aspects of life with COVID-19 have been very disheartening, it has also been encouraging to see the creativity and adaptability of so many individuals and institutions.

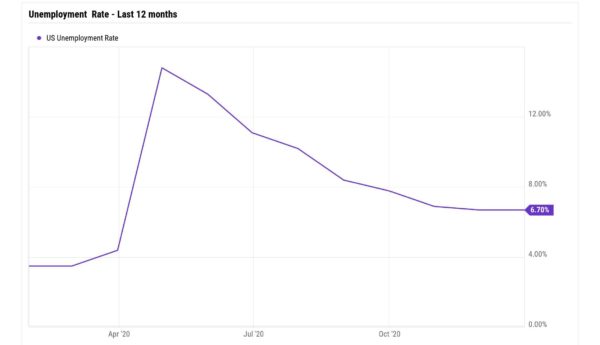

At present, we do not expect the Federal Reserve or other central banks to raise interest rates anytime soon. The Fed seems much more focused on restoring low unemployment levels, and, given that inflation is quite tame right now, we think the Fed has ample talking points on why it will continue keeping rates low.

In terms of the other main pillars of economic growth – trade, taxes/spending, and regulation – the greatest attention is being paid to taxes. While we do expect the incoming administration to seek to raise tax rates, the proposals most likely to pass are unlikely to be at a level that might completely retard economic growth.

Last year was unprecedented. What has not changed is REDW Wealth’s commitment to helping our clients navigate their own financial waters. As you communicate with us through your Relationship Manager, please let us know about any changes in your life or goals so that we can address them.

Copyright 2021 REDW Wealth, LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.